Ekaterina Krasnikova/iStock via Getty Images

A Quick Take On Driven Brands

Driven Brands (NASDAQ:DRVN) reported its Q4 2022 financial results on February 22, 2023, missing revenue but beating EPS consensus estimates.

The firm provides various maintenance and repair services for automobiles in the United States.

My outlook on Driven Brands in the near term is on Hold, although growing vehicle miles traveled may present potential upside to the stock.

Driven Brands Overview

Charlotte, North Carolina-based Driven Brands was founded to develop an asset-light business model of corporate-owned and franchised consumer and commercial automotive maintenance services.

Management is headed by president, CEO and Director Jonathan Fitzpatrick, who has been with the firm since 2021 and was previously in various senior roles at Burger King Corporation.

The company’s primary offerings include:

-

Paint, Collision & Glass repair

-

General Maintenance

-

Car Wash

-

Platform Services

The company advertises its various brand offerings through a combination of traditional, digital and offline advertising as well as through locating its stores in visible areas to significant drive-by traffic.

Driven Brands’ Market & Competition

According to a 2020 market research report by First Research, the global automotive repair and maintenance services market is estimated to grow at a double-digit compound annual growth rate from 2015 to 2025.

A significant source of the forecast growth will be from growing vehicle production in emerging markets such as India and China.

The U.S. auto repair industry is currently valued at around $115 billion in annual revenue and is highly fragmented, with an estimated 162,000 establishments, both single-location firms and companies with multiple locations.

It is estimated that the 50 largest repair and maintenance companies account for less than 10{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} of total revenue.

The company faces significant competition from a variety of sources:

-

Do-it-for-me service providers

-

Do-it-yourself

-

Automobile dealerships

-

Online retailers

-

Wholesale distributors

-

Hardware stores

-

Discount and mass merchandise stores

Driven Brands’ Recent Financial Results

-

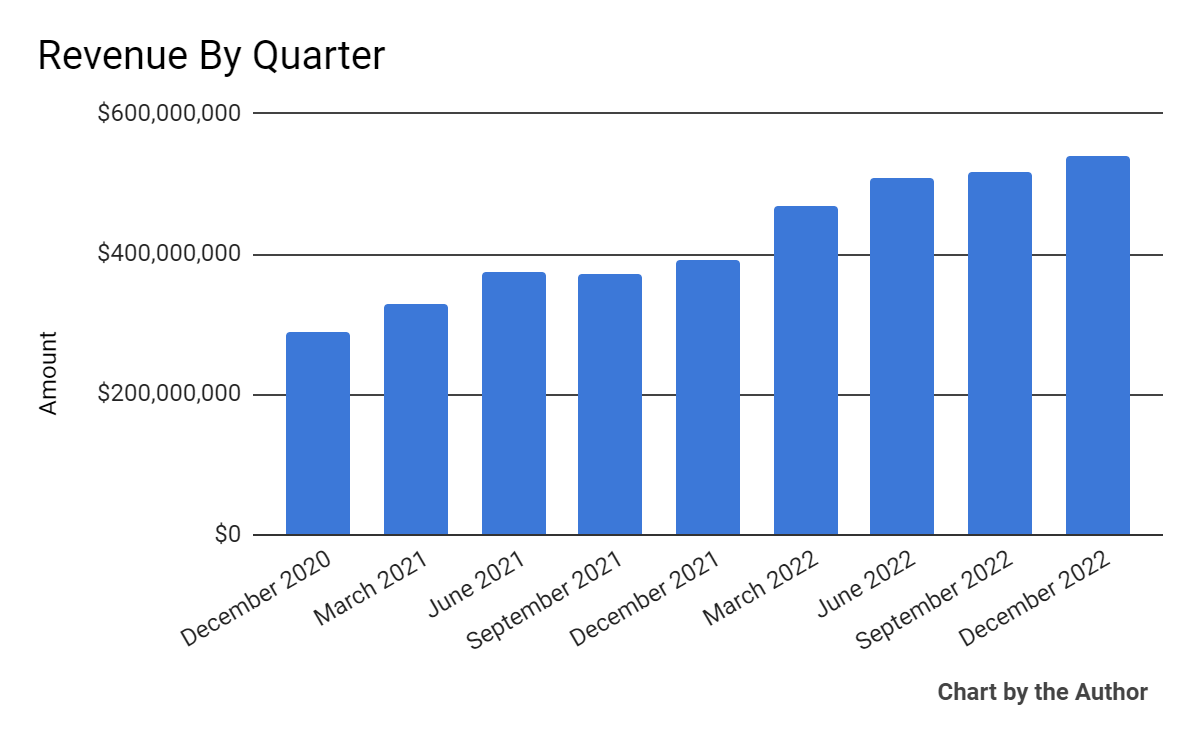

Total revenue by quarter has risen impressively, as the chart shows below:

Total Revenue (Seeking Alpha)

-

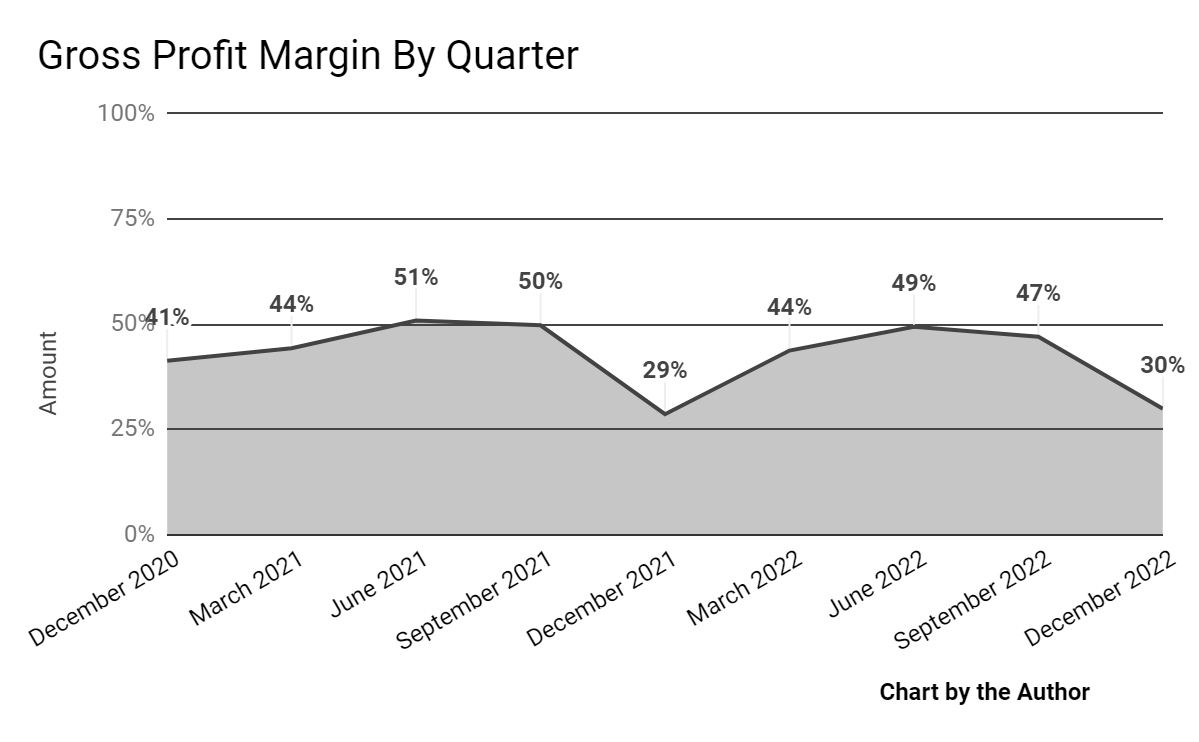

Gross profit margin by quarter has produced the following results:

Gross Profit Margin (Seeking Alpha)

-

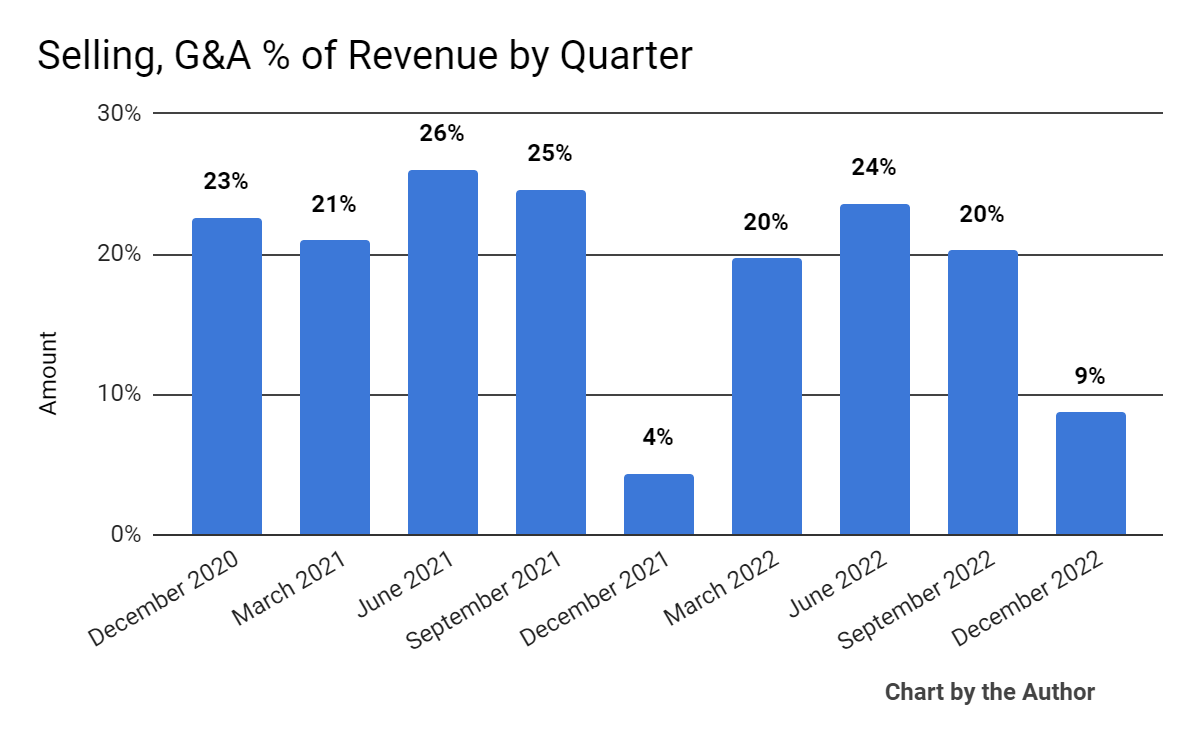

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated as follows:

Selling, G&A {e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} Of Revenue (Seeking Alpha)

-

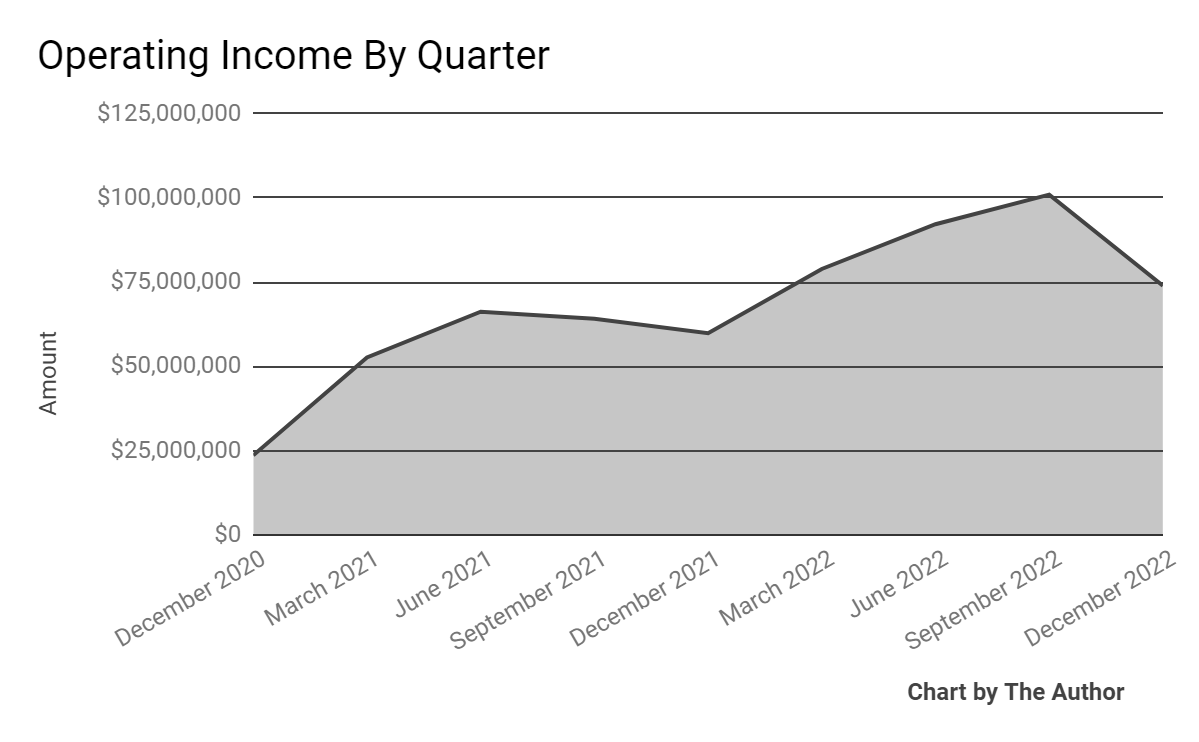

Operating income by quarter has trended higher, as the chart shows below:

Operating Income (Seeking Alpha)

-

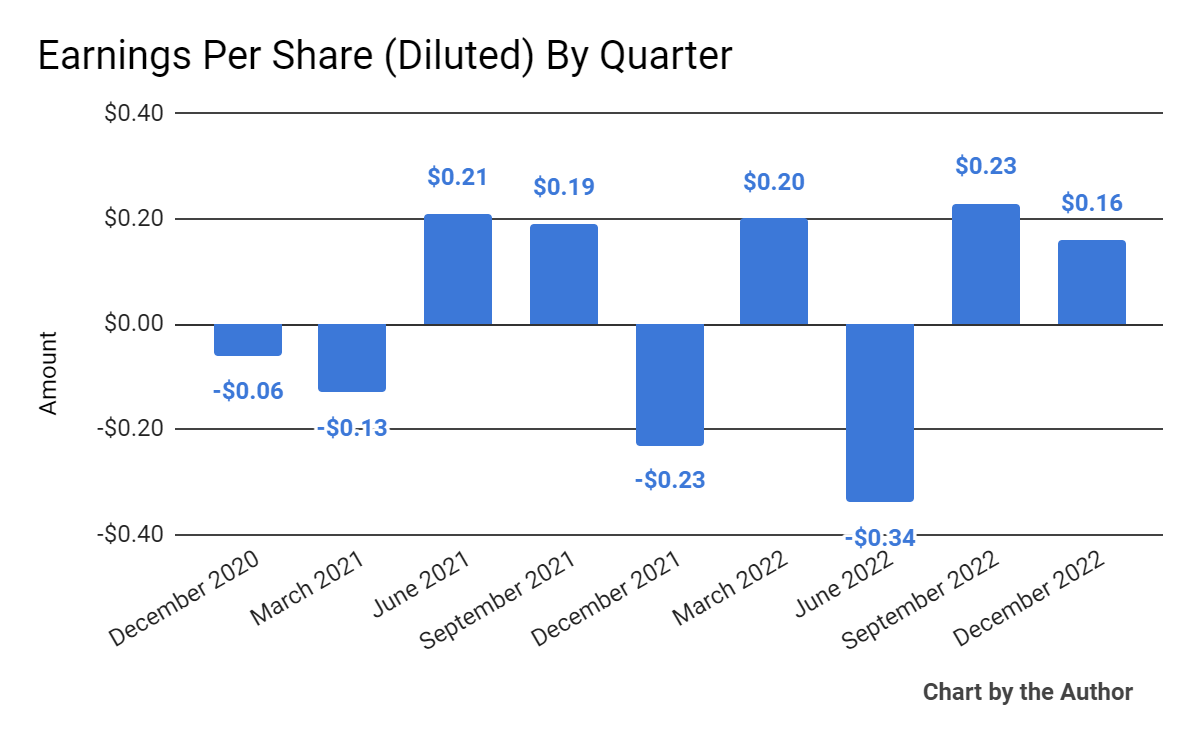

Earnings per share (Diluted) have fluctuated materially:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

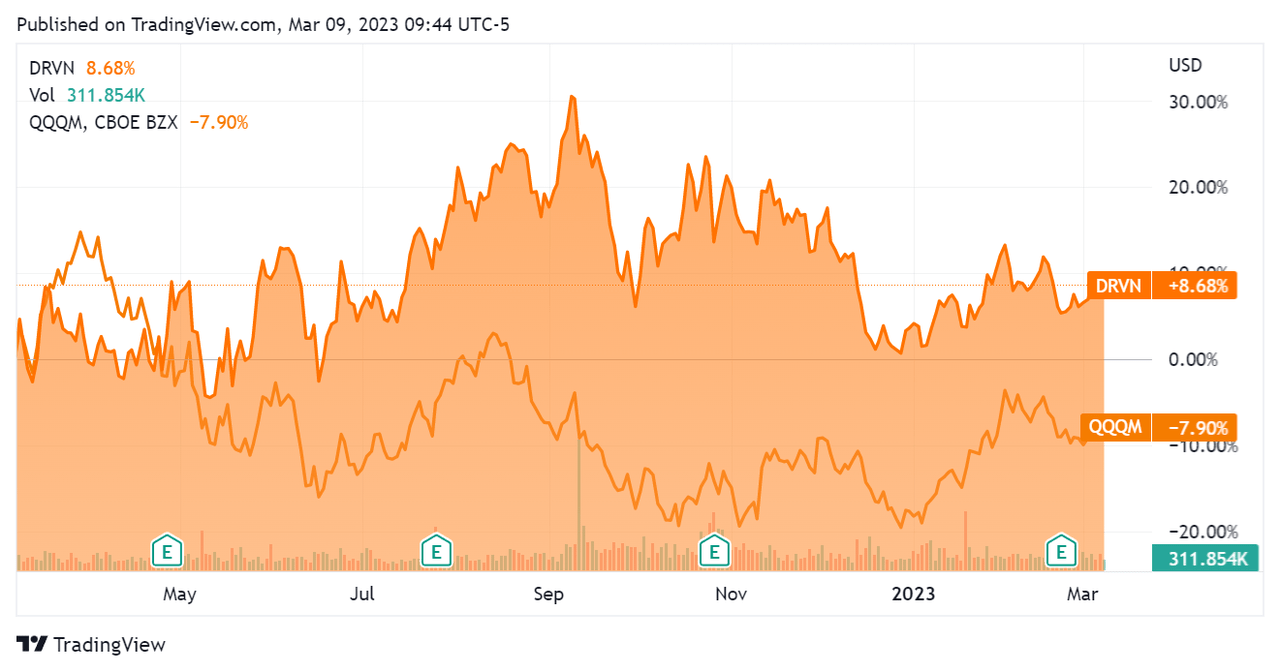

In the past 12 months, DRVN’s stock price has risen 8.7{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} vs. that of the Nasdaq 100 Index’s drop of 7.9{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee}, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

As to its Q4 2022 financial results, total revenue rose 37.7{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} year-over-year, while gross profit margin grew by one percentage point.

SG&A as a percentage of revenue has been trending slightly lower in certain quarters and operating income has been trending higher in recent quarters, subject to usual seasonal factors.

For the balance sheet, the company ended the quarter with $227.1 million in cash and equivalents and $2.7 billion in total debt.

Over the trailing twelve months, free cash used was $239 million, of which capital expenditures accounted for $436.2 million. The company paid $20.6 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Driven Brands

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.2 |

|

Enterprise Value / EBITDA |

17.3 |

|

Price / Sales |

2.3 |

|

Revenue Growth Rate |

38.6{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} |

|

Net Income Margin |

2.1{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} |

|

GAAP EBITDA {e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} |

24.3{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} |

|

Market Capitalization |

$4,780,000,000 |

|

Enterprise Value |

$8,550,000,000 |

|

Operating Cash Flow |

$197,180,000 |

|

Earnings Per Share (Fully Diluted) |

$0.25 |

(Source – Seeking Alpha)

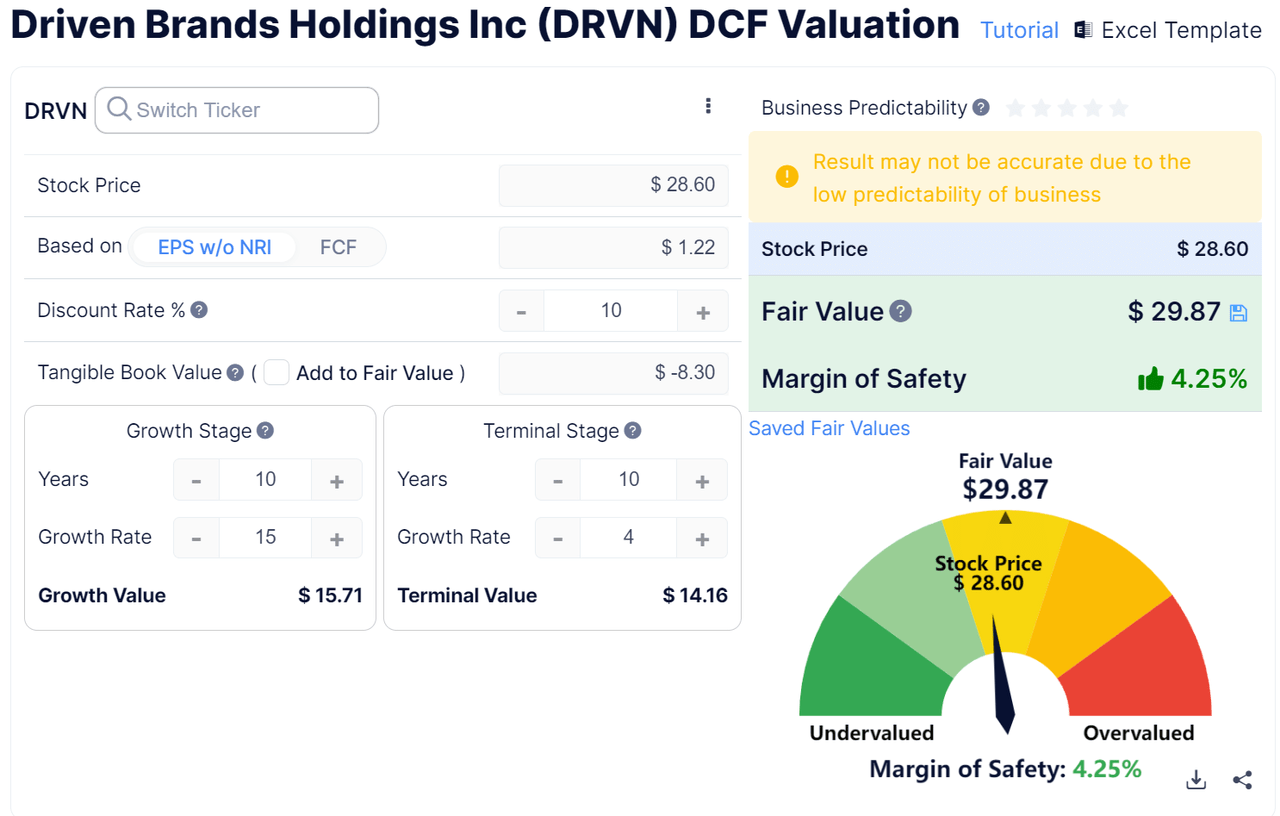

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $29.87 versus the current price of $28.60, indicating they are potentially currently slightly undervalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Future Prospects For Driven Brands

In its last earnings call (Source – Seeking Alpha), covering Q4 2022’s results, management highlighted the momentum it has going into 2023, along with ‘excellent visibility into [its] expense base.’

Leadership asserted that the Take 5 brand in the Quick Lube category is the 2nd most recognized brand in its category in the U.S.

The company intends to grow its footprint to 950 locations, or an additional 20{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} in 2023.

For its car wash segment, the company expects to open 65 new locations in 2023 as it experiences ‘some headwinds in the fourth quarter related to foreign exchange and software retail volume as a result of the macroeconomic environment.’

This highlights that while much of its business may be recession-resistant, the discretionary car wash business may be more negatively affected due to discretionary characteristics.

In its auto glass segment, the company will continue to migrate its branding and footprint to Auto Glass Now and management plans to expand its commercial volume through the addition of fleet and regional/large insurers ‘in late 2023 and 2024.’

Looking ahead, management expects vehicle miles traveled to increase from 1{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} growth in 2022 to 3{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} – 4{e410be007f3fd0fc7192ddce64f064014ac3d4d0ef675ed9817a95680a41cfee} growth in 2023.

The firm expects total 2023 revenue of $2.35 billion and adjusted EBITDA of $590 million.

Regarding valuation, my discounted cash flow analysis, which used quite generous growth assumptions, indicates the stock may be fully valued at around $29.00 per share.

While the company may be largely resilient to a recession or slowdown, the stock may not have that much upside left in it, at least for the short term.

Accordingly, my outlook on Driven Brands in the near term is on Hold, although growing vehicle miles traveled may present potential upside to the stock.